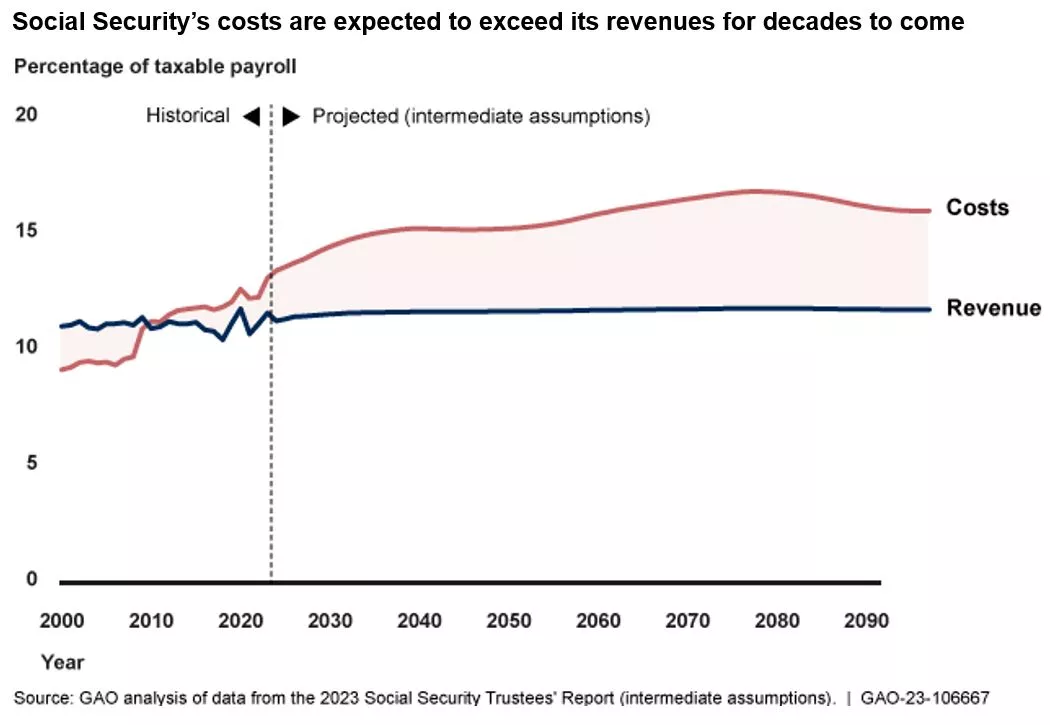

Generations of Americans have relied on Social Security as a key source of retirement income. But the entitlement program faces serious financial challenges that, if left unaddressed, could leave it unable to pay scheduled benefits in full starting in 2033.

Today’s WatchBlog post looks at our new report—the third and last in a series—about Social Security reform options. These options were introduced in Congress, identified in literature, or suggested by Social Security experts.

Social Security’s Old-Age and Survivors Insurance (OASI) program is often what most people think of when they think of Social Security. The program has paid out more money than it received (in taxes) since 2010. Trustees that oversee Social Security’s finances say that the program’s reserve funds will be exhausted in less than 10 years if no action is taken. This could mean that retirees receive only about 79% of their scheduled benefits.

The sooner action is taken the better. Acting now to address Social Security’s financial woes would reduce the impacts of changes on beneficiaries. Acting now would allow changes to be gradually phased in. It would also give Americans more time to plan for any changes affecting their retirement security. Our May 2023 report and podcast with GAO’s Kris Nguyen discusses the importance of early action.

Improving finances by reducing program costs. Social Security provides monthly benefits to retired workers and, in some cases, their dependents and survivors. The program is primarily funded through payroll taxes. Policymakers could reduce program costs by changing eligibility and benefit amounts. These changes could reduce current or future benefit amounts for everyone or for certain groups.

Improving finances by increasing program revenues. Benefits are largely financed through Social Security payroll tax revenues. Some options to increase revenues would maintain this structure by increasing the amount of payroll tax revenues that the program collects, while others would increase the amount of resources available to the program by using revenues from outside of Social Security’s existing revenue sources.

Options with mixed or uncertain financial effects. Policymakers may choose a package of reform options that include some with mixed or uncertain effects on Social Security’s finances.

For example, policymakers could increase both revenues and costs by extending benefits to state and local government employees who are not currently covered by Social Security. About one in four of these employees are not covered by the program. Extending coverage to these employees would initially improve the program’s finances because these employees would start paying payroll taxes, while initially receiving few benefits. But long term, this change would ultimately worsen Social Security’s financial outlook.

Options that pursue nonfinancial goals. Policymakers may look to reduce the impacts of reforms on particularly vulnerable beneficiaries. They may also seek to modernize aspects of Social Security by increasing benefits for some individuals to respond to changes in society. These options could achieve important nonfinancial goals but could also make it harder to solve Social Security’s financial challenges.

The above-described options are just some of those outlined in our new report. Learn more about these options and get more details about them in our full new report.

Our work has also identified important questions and criteria policymakers should consider when evaluating options. Learn more about that work in our November 2023 report.